"Steve, how can you even think that long-term interest rates could possibly go LOWER?" you might be asking...

"Don't you know? EVERYONE believes interest rates are headed higher."

You are right... EVERYONE believes interest rates are headed higher.

The thing is, the fact that EVERYONE is already in this trade is the reason why interest rates will struggle in the next three months or less...

The evidence is stacking up everywhere that we are at an extreme in interest rates right now. EVERYONE believes that long-term interest rates are headed higher...

Let me share a few examples:

|

• |

According to the latest Global Fund Manager Survey from Bank of America, fund managers are so scared of higher interest rates, they are avoiding bonds to the greatest degree in the decades-long history of the survey. (Fund managers are more "underweight" bonds than ever.) |

|

• |

"Inflation and a bond crash" is what worries fund managers the most, according to the same survey. |

|

• |

Traders have placed their second-largest bets in decades on higher interest rates (based on trading in the futures markets for 10-year government bonds). |

The last time futures traders placed so many bets on higher interest rates was early last year.

What happened next? Interest rates on 10-year U.S. Treasury notes went DOWN – from 2.6% in March to 2.15% in June.

It doesn't matter what the investment is – whenever you see EVERYONE betting the same direction on a trade, that trade is typically almost over.

Bond investors are betting on higher interest rates to a near-unprecedented degree.

I expect – over the next three months – they will be wrong in that bet.

I'm not betting against them because of their reasons. I'm betting against them because no one is left to join their argument...

Everyone who wants to bet on higher rates has done so. That means nobody is left to join the trade and push rates higher.

Now, I don't have a trade in place – yet. I'm waiting for the trend in interest rates to start falling.

Once the trend is here, I'll likely place a three-month bet that long-term interest rates will go DOWN.

Are you bold enough to go against EVERYONE and do the same?

If I'm right, and interest rates go down, it could fuel another leg up in stock prices. And what I've called the "Melt Up" in stocks could explode even higher.

Stay on board with stocks...

Good investing,

Steve

P.S. The moment I've been waiting for has arrived... The Melt Up is finally here. But if you wait any longer to take advantage of it, you'll almost certainly miss out. So for a short time, I'm sharing a final offer to get in on my most important Melt Up research – with specific recommendations for how to cash in on the last stages of this bull market... Click here to learn more.

Further Reading:

"Fears of higher interest rates are hitting an extreme right now," Steve writes. That means investors are scared of bonds... And it's time to go against the crowd. Read more here: Are You Contrarian Enough for This Trade?

If interest rates fall, it could drive stocks even higher... And you don't want to miss it. Recently, Brett Eversole explained more about why we're staying long today. Check out his essay right here: Investors Are 'All In' – But Selling Could Be a Terrible Mistake.

Lower rates could mean higher prices for income investments. And this could potentially boost one of Dave Eifrig's recent recommendations, which pays a hefty dividend...

SELLING DOMAIN NAMES IS A WINNING STRATEGY

One of our favorite ways to profit from flourishing trends is through "picks and shovels." These businesses sell the tools and services that power entire sectors. Since the whole industry relies on their support, buying picks-and-shovels stocks is less risky than betting on a single potential winner. We can see this concept succeeding today with a company that sells website names...

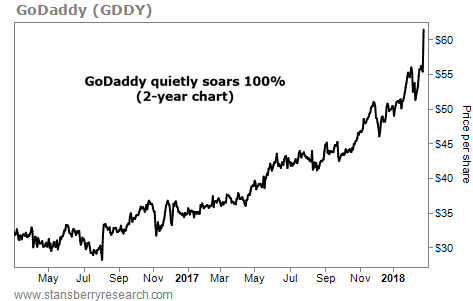

GoDaddy (GDDY) is the world's largest provider of domain names. It also acts as a marketplace for previously owned domains. With the continued rise of Internet trends like social media, blogging, and e-commerce, GoDaddy's business has only grown more important... Last quarter, its customer base jumped to 17.3 million users – an 18% increase from last year. And its sales jumped 24% over the same period.

As you can see, GoDaddy shares are in a steady uptrend. They nearly doubled over the past two years... and just broke out to an all-time high. As long as the Internet keeps adding more websites, GoDaddy will thrive...