Editor's note: The layoffs we've seen at many Big Tech companies are spreading to other sectors. But according to Joel Litman – founder of our corporate affiliate Altimetry – that's not necessarily a sign of financial troubles. In this article, adapted from a recent issue of the free Altimetry Daily Authority e-letter, Joel highlights why AI means we'll see more changes to the corporate workforce... even at companies with plenty of cash.

Programmers everywhere are seeing a worrying trend...

Since early 2023, some of the biggest names in AI have been firing people.

Microsoft, Alphabet, Amazon, Salesforce, and many other market leaders have been letting people go – and it's not for lack of work.

The AI explosion has made companies rethink where they need staff. As they cut spending in non-AI departments, they're letting people go. On top of that, they're also finding that AI advances are letting them get by with fewer workers.

Programmers at Big Tech companies can no longer brag about only doing five to 10 hours of work a week.

As I'll cover today, though, it's not just the Big Tech powerhouses. Other companies are catching on to the potential of these efficiency gains... which means we'll see more layoffs to come.

Just last week, Intuit (INTU) announced it was cutting 10% of its workforce...

However, the financial-software maker – with popular brands like TurboTax, QuickBooks, and Credit Karma – isn't a struggling business. Far from it, in fact.

In a letter to employees, CEO Sasan Goodarzi said that while the layoffs had targeted low performers at the company, the staffing changes happened for a bigger reason.

Goodarzi wants engineers, product staff, and sales staff who can help the company ramp up its AI offerings. He let go of 1,800 people, and he's planning on hiring a similar number back... but in new, AI-related roles.

Intuit is doing just fine financially. It beat earnings expectations by 50 cents last quarter, coming in at $9.88 in earnings per share. And it comfortably beat revenue estimates, too.

Year-over-year revenue growth was 12% in the last 12 months, and operating earnings has grown by 22%. In other words, almost every metric is looking up for Intuit.

And now, it's hoping to keep up that impressive growth by investing in AI.

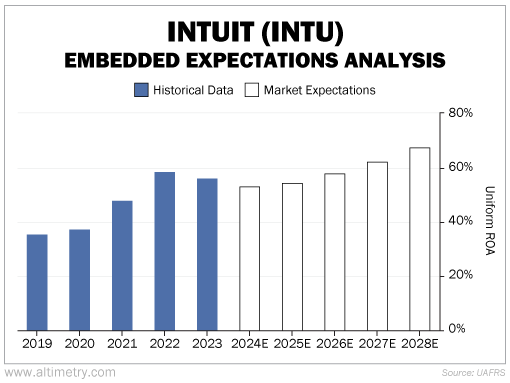

The market is betting that Intuit's moves will not only maintain growth, but also boost profits in a big way. We can see what the market believes is ahead for Intuit using Altimetry's Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from future cash flows. We then compare that with our own cash-flow projections.

In short, this tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Intuit has been doing a great job reinvesting in its business over the past two years. It grew assets at a double-digit rate in both 2022 and 2023.

At the same time, Uniform return on assets ("ROA"), a metric of the company's profitability, got a bump from growing demand. It soared to more than 55% in both years. That's up from mid-30% levels in the past.

The market thinks Intuit can keep up that growth. It expects that Intuit's AI bets will allow the company to keep growing by double digits each year.

That's not all, though. The market also thinks Intuit can see its already impressive 55% Uniform ROA soar to almost 70% over the next few years...

Now, this might seem far-fetched. Surely Intuit isn't going to hit those kinds of returns if it's replacing 1,800 employees with new employees, new bonus plans, and new stock-option packages.

But it looks like the market thinks Intuit knows that. Like some of the Big Tech giants, Intuit isn't only going to find ways to build AI products for its clients... It's also going to use AI for its own benefit.

While 70% Uniform ROA might be a tough goal to hit, it's possible. And efficiency gains should lead this company to impressive growth for years to come.

Intuit isn't the only business catching on to how AI can both boost revenue and save costs...

We're in the early innings of the AI boom. That goes far beyond what Nvidia, Microsoft, Alphabet, and some of the other biggest "AI darlings" are doing.

This change is coming fast. It's already creating big changes across the economy – from jobs to products to entire industries.

And behind the AI revolution is a single, dramatic event that's set to shake up the entire stock market (and completely blindside investors)...

That's why I just hosted an "AI Panic Summit" yesterday. I revealed the AI bombshell no one is talking about... and the No. 1 step you need to take with your money today. Click here to watch a replay of the event.

For the sake of your long-term wealth, this is information you won't want to miss.

Regards,

Joel Litman

Editor's note: Joel is a Wall Street veteran with decades of experience. He's one of America's most respected financial experts. And yesterday, he sat down to share an urgent message. In short, Joel believes we're just days away from an event that could cause panic in the market – and AI stocks are at the heart of it.

The last time we saw anything like this, at least 10 different stocks went up 1,000% or more... while millions of Americans saw their stock portfolios devastated... Click here to learn more and hear Joel's warning.

Further Reading

"Consumers are reeling in their spending as fast as they can," Rob Spivey writes. Despite the strength in the AI and semiconductor space, everyday Americans are still under strain. And until that changes, it's going to be a problem for the economy... Read more here.

Chipmaker Nvidia has come a long way in a short amount of time. It's unlikely another tech company will be able to usurp its throne in AI software – at least, not anytime soon. And it's all thanks to the tech king's competitive advantage... Learn more here.