Editor's note: If you want to understand the risks of a potential investment, consider its credit history. Joel Litman, founder of our corporate affiliate Altimetry, notes that it can help reveal a company's performance over time... and its strength to withstand tough markets.

In today's Weekend Edition, we're taking a break from our usual fare to share a recent piece of his, adapted from the free Altimetry Daily Authority e-letter. In it, Joel explains why some kinds of companies are "safer" risks than others.

Also, the markets and our offices will be closed on Monday in observance of Martin Luther King Jr. Day. So keep an eye out for your next issue of DailyWealth on Tuesday.

Two men walk into a bank looking for a $1 million loan...

One is a successful businessman with a hefty $10 million in cash. He also has investments and a business under his belt, with $20 million in debt... all with the same bank.

The other is a diligent Amazon worker with a spotless credit record, zero debt, and $50,000 in savings.

Now, let me ask you a question – who's more likely to snag that $1 million loan?

If you guessed the businessman, congratulations. You're absolutely right.

The bank knows this man well. It sees his $10 million in liquid assets... and figures his business must be doing all right to manage a $20 million debt load.

An extra million dollars is a small step up... just 5% more debt.

As for the Amazon worker, the bank doesn't have much to go on. A $1 million loan would be a huge leap from what this guy is used to handling.

While it might seem counterintuitive, this is a situation that has played out countless times in corporate America. Today, I'll explain why huge companies with a lot of debt often get better treatment than small companies that look safer on the surface...

Even if you've never set foot in the bond market, what's going on in credit can have a huge impact on stocks. So I always urge folks to keep an eye on credit health, particularly in a volatile market like this.

That's why we were so impressed with a recent question from Altimetry subscriber Robert B. of Bristol, England.

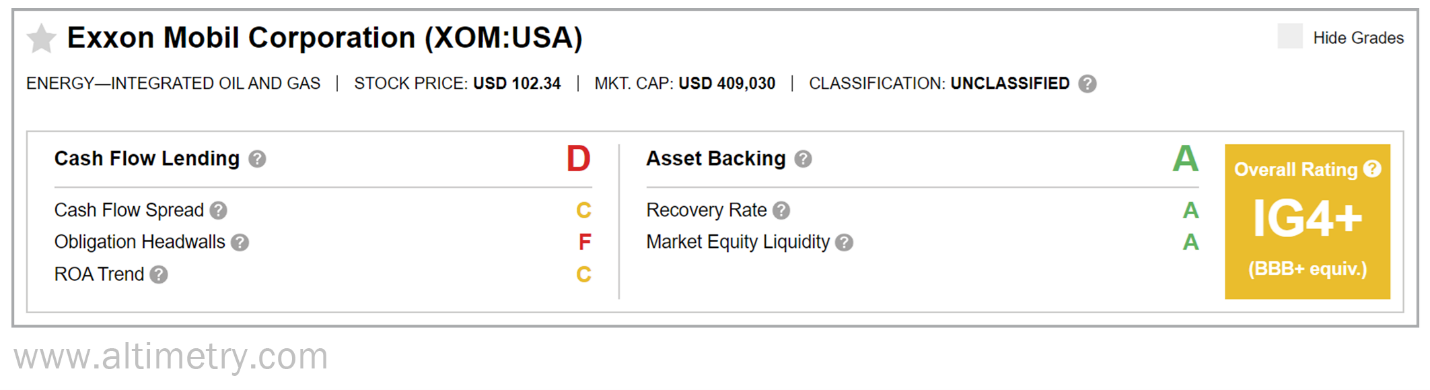

He noticed that tools like Altimetry's Credit Analyzer – which provides risk profiles for any U.S. company – use market cap as a factor for determining credit health. The larger the company, the better the grade it receives on "Market Equity Liquidity."

Meanwhile, the Credit Analyzer's "Recovery Rate" grade gives us an idea of how much money creditors can expect to get back if a company goes bankrupt. It's roughly the value of a company's assets compared with its debt.

The analyzer's "Asset Backing" grade averages those two measures. Here's how it looks when you put it together in the Credit Analyzer...

Robert made the point that smaller companies might have an edge in debt management and asset liquidation... which would give them higher recovery rates than larger companies. It's the difference between having to sell a fleet of 10 vans instead of 1,000.

He wondered whether market cap – or the total value of a company's shares – might only tell part of the story about its ability to settle debts. That value is in the hands of shareholders, after all.

However, let's go back to our $1 million loan example...

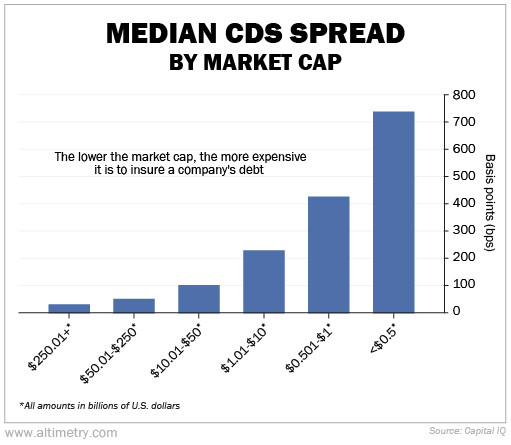

When it comes to corporations, we can see a similar relationship through credit default swaps ("CDS")...

A CDS is a type of financial derivative that allows an investor to "swap" or offset their credit risk with another investor. It provides insurance against the risk of a default by a particular company or by companies of different sizes.

The price of a CDS is also called the "spread."

Like our businessman with $10 million in cash, larger companies often have a proven ability to sustain debt. They typically possess stronger defenses against market shifts... like a wider customer base or a more diverse product line.

Smaller companies tend to have higher CDS spreads. Lenders view them as much riskier and aren't as willing to lend to them.

For companies with market caps of more than $50 billion, CDS costs are less than 100 basis points ("bps") per year... or 1% of the price of the loan.

Companies with market caps below $1 billion cost more than 400 bps (4%) per year to insure. And the very smallest companies – those worth less than $500 million – cost investors more than 700 bps (7%) per year.

Take a look...

CDS spreads are a risk assessment based on track record and scale. So when smaller companies have higher spreads, it's the market's way of saying that it hasn't seen enough...

Investors don't trust that smaller companies can handle this much debt.

And in the world of credit, bigger often equals better...

Now, that doesn't mean big companies can't fail or that small ones are always risky. It's about patterns and probabilities.

That's why when we look at credit risk, we're not just looking at a company's current debt or assets. We're also checking its history of managing debt, its liquid assets, and what the market thinks of its ability to keep the lights on and the doors open.

So when it comes to assessing the credit risk of the stocks and bonds you own, don't assume a company with less debt is automatically safer.

Banks pay attention to credit history... and they'll make sure to take care of their biggest customers.

Regards,

Joel Litman

Editor's note: Ten of the world's biggest money managers depend on Joel's market analysis. And it's critical to pay attention – because right now, Joel is sounding the alarm. A wave of bankruptcies is about to hit the markets in 2024, based on his research... with ripple effects throughout the economy.

If you're like most Americans today, your money could be at serious risk. But one little-known strategy that actually benefits from these events is just starting an extraordinary run... And it means investors have a way to protect themselves – and even profit – from what Joel expects will unfold soon. Click here for the full story.