Editor's note: After more than a year of rate hikes, many investors expect the Federal Reserve will start cutting rates soon. But Joel Litman – founder of our corporate affiliate Altimetry – says that rates aren't the only measure we should be watching. In this piece, adapted from a recent issue of the free Altimetry Daily Authority e-letter, Joel explains why the central bank isn't done meddling with the economy just yet...

Investors were mostly focused on one thing at the end of 2023... the promised "Fed pivot."

You see, now that the central bank is done hiking interest rates – and has seemingly won its battle against inflation – it may soon move on to rate cuts.

The Federal Reserve potentially easing financial conditions is a major boon for the market. It means stocks can continue heading higher...

So, when inflation came in lower than expected in October and November, investors swung bullish. Their optimism pushed the market up 14% during the last two months of 2023.

That said, just because the Fed may be done raising interest rates doesn't mean it's throwing its tight monetary policies completely out the window...

The central bank has an arsenal of tools it can use to influence the economy and control the availability of credit. It doesn't solely rely on interest rates.

As I'll explain, there's one other tool the Fed is using to cool the economy today. And it doesn't seem to be in a rush to hit the "reverse" button anytime soon...

The Fed is still running off its trillion-dollar balance sheet...

It implemented its quantitative-tightening ("QT") program in June 2022 – just a few months after it had kicked off interest-rate hikes.

QT – along with its sibling quantitative easing ("QE") – is a way for the central bank to manage how much money is moving through the system. Basically, the Fed influences the money supply by making big purchases and sales of U.S. Treasurys and other assets like mortgage-backed securities.

In QE, the Fed buys assets. This means it pushes cash into the market, creating more money for banks to use to make loans. In QT, it sells assets, meaning it takes cash out of the system. This generally slows down the economy and helps ease inflation.

In 2022, the central bank began selling off a majority of the assets it had acquired in 2020 to try and remove excess liquidity from the system.

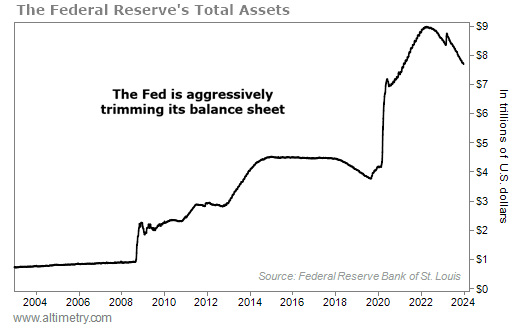

So far, the Fed's balance sheet has shrunk by more than $1.3 trillion. It's now down about 14% from its March 2022 peak. Check it out...

In other words, it's aggressively taking available capital out of the economy.

And Fed Chair Jerome Powell has stated the central bank has no plans to stop anytime soon... Despite pausing interest-rate hikes these past few months, the Fed is planning to stay the course on its QT program.

This is similar to what happened in the late 1940s... when the central bank aggressively ran down its balance sheet to tame rampant inflation.

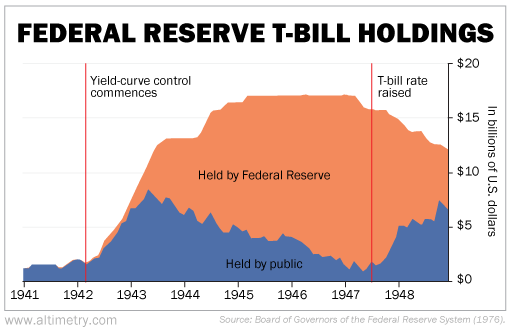

In early 1947, the Fed owned roughly 90% of all U.S. T-bills...

Starting in 1942, it began buying U.S. government debt to control the yield curve and finance the war effort.

In total, the Fed owned roughly 10% of federal debt at the time. (For comparison, the central bank owns roughly 15% of federal debt today.)

After the war, it continued buying debt to avoid disrupting the economy... until inflation became a major issue in late 1946 and 1947. Inflation eventually peaked at just over 20% in March 1947.

With inflation at such astronomical levels, the Fed used any tool it could to cool off the economy. It increased Treasury bill rates... tightened reserve requirements... and most importantly, it started selling off its massive pile of assets.

In roughly a year and a half, the Fed cut its T-bill ownership in half... from more than 90% to less than 45%. Take a look...

The Fed ran down its T-bill holdings by roughly $9 billion. At the time, the amount of cash it took out of the system was equivalent to roughly 3.6% of U.S. gross domestic product ("GDP").

The aggressive rundown of assets, combined with rate hikes and tighter reserve requirements, successfully brought down inflation.

But it also sent the U.S. into a mild recession.

As the saying goes, "While history may not repeat itself, it often rhymes"...

Today, the Fed's $1.3 trillion balance-sheet rundown is equal to roughly 6% of U.S. GDP.

So, not only has it raised interest rates at the fastest pace in four decades... it has also been more aggressive with quantitative tightening than it was in the late 1940s.

Back then, the Fed's monetary policies pushed us into a mild recession. This time, we're on track for something similar.

What's more, the agency is continuing to pursue that tightening, even as it halts interest-rate hikes.

In our view, anyone claiming that the Fed is "pivoting" – and that we're set for a soft landing – is too optimistic. I suggest you remain cautious today... because tight monetary policy isn't over yet.

Regards,

Joel Litman

Editor's note: Joel predicts 2024 will be a rocky road for investors based on one ironclad "law" of finance. He believes we'll see a massive wave of bankruptcies this year... And it'll likely be much worse than what we experienced in 2009. That's why Joel is urging folks to prepare now, using his favorite "backdoor" strategy. If you have any money in stocks today, listen to his message before it goes offline... Click here for the full details.

Further Reading

"The cracks are starting to show in the economy," Rob Spivey writes. In tight environments, "riskier" companies are the first to suffer. That can lead to panic-selling in stocks. But one hidden investment opportunity provides a way to profit from the volatility... Read more here.

"More companies are on the brink of bankruptcy than many folks realize," Joel writes. Corporate stress is increasing in the U.S. That tells us that many companies are struggling right now. And that should be a warning sign for investors... Learn more here.