A funny thing happened during the late 1990s dot-com mania...

It had never happened before. And it hasn't happened since.

But it may be starting to happen again...

It has to do with volatility... And you need to prepare now.

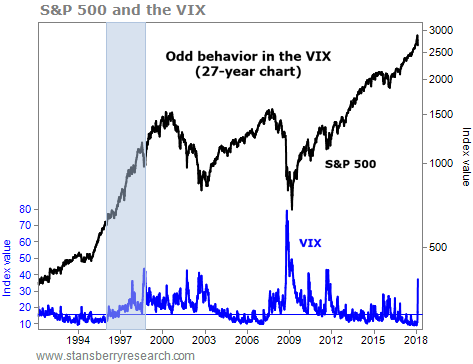

The CBOE Volatility Index (or "VIX") is one of the most widely used financial gauges in the world. It measures expected volatility in the benchmark S&P 500 Index over the next 30 days. In general, a VIX below 20 is considered low, and a VIX above 30 is considered high.

As you probably know, volatility stayed extremely low last year...

In 2017, the VIX closed above 16 just once... at 16.04. It averaged just 11.1 for the year.

This is extremely unusual. In the 28-year history of the VIX, the only time it spent a full 12 months below 16 was in 1995. (That year, it averaged 12.4.)

The VIX typically rises when stocks fall, and falls when stocks rise. So the VIX often jumps above 20 when stocks go through normal corrections. But last year and 1995 were both during historic bull markets... And normal corrections didn't take place.

It was odd behavior in both cases. But something funny happened after the calm of 1995...

During the dot-com mania, the VIX rose as stocks rose. (Again, usually, they move opposite one another.) You can see this in the chart below, highlighted in blue...

The VIX averaged 12.4 in 1995. Then, it started to rise...

|

Year

|

Average VIX

|

|

1995

|

12.4

|

|

1996

|

16.4

|

|

1997

|

22.4

|

|

1998

|

25.6

|

|

1999

|

24.4

|

|

2000

|

23.3

|

|

2001

|

25.7

|

|

2002

|

27.3

|

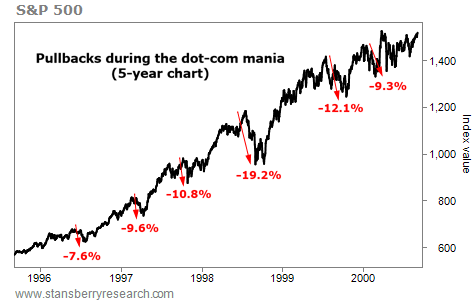

However, the VIX didn't rise without reason. Volatility returned to the stock market...

The S&P 500 soared 148% from the end of 1995 through March 23, 2000. You can see the size of the corrections during this mania phase below...

We should expect this sort of volatility during a period of rapidly rising prices. But until recently – like in 1995 – we haven't had it.

So now, it's no surprise that we've finally seen our first "official" correction since the summer of 2015...

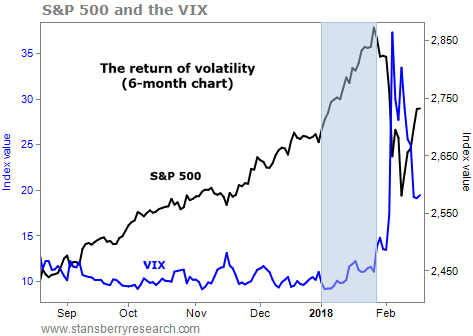

Stocks have been humming along without many hiccups for almost nine years. But last year may have been the start of a mania – or what my colleague Steve Sjuggerud calls the "Melt Up."

If we are entering a period similar to the late 1990s – and signs point to this being the case – then it was only a matter of time before volatility returned. And now it has...

Last month, the VIX and stocks climbed in unison... similar to what happened after 1995. Then came the correction...

Stocks can continue higher in the coming months... But don't expect to see another long stretch with such low volatility anytime soon.

My advice is to prepare for both – rising overall stock prices AND volatility. You can do this with the help of a simple strategy...

Normally, in my DailyWealth Trader service, we use tight stop losses when we enter new positions. And we keep them tight as they move in our favor. This way, we never risk losing too much of our initial investment... or giving back a big portion of our gains.

As volatility rises, though, keeping your stops too tight would likely mean stopping out of lots of bullish trades just before they continue higher.

So you want to trade in a way that will keep your initial risk low... but still give your trades the "wiggle room" they need to turn into big double- and triple-digit winners.

You can do this by using tight stop losses when you enter trades, then giving them more slack as they move in your favor.

If last year was the first year of the Melt Up, big gains are ahead. And the only way you'll capture those big gains is if you're prepared to deal with volatility.

It will likely be uncomfortable when stocks pull back. But this strategy is one of the best ways to prepare for the return of volatility... and an exciting, profitable year in the markets.

Good trading,

Ben Morris

Editor's note: Rising volatility can create lucrative opportunities – and this is where Ben's "trading for income" strategy truly shines. It's one of many tools he shares with his readers... And it's a great way to collect cash – with less risk – as the market's "fear gauge" goes wild. To learn more about his

DailyWealth Trader service,

click here.

Further Reading:

"The market had its worst week in more than a year – after hitting a 52-week high," Steve writes. That's pretty extreme. And it's an incredibly bullish sign... Learn more here: 100% Chance of New Highs in the Next Six Months.

"Traders and investors have become nervous over the last few weeks, looking for a reason to sell," Steve says. Financial experts say inflation is partly to blame. But history tells a different story... Read more here.

Today, we are following the blueprint of the last Melt Up... Stocks will likely rally from here. That's why my colleague Dave Eifrig shared a small technology company with our True Wealth Systems readers – one that could soar as the Melt Up continues...

THE UPTREND IN DATA SECURITY

Most companies lose when hackers steal data. But today, we'll show you one that wins...

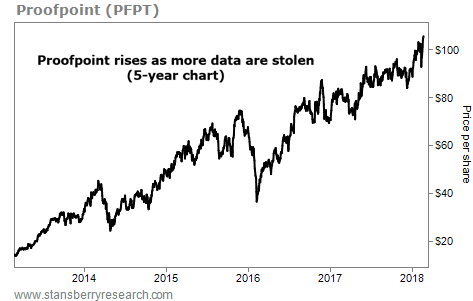

Regular readers know we are always looking to invest in big secular trends. Today, one of these trends is the personal data we store on the Internet... and the growing need for cybersecurity. Last year's breach at credit-reporting bureau Equifax (EFX) compromised the personal information of about 145 million Americans. As hacks like this keep increasing, more businesses will turn to cybersecurity experts for help.

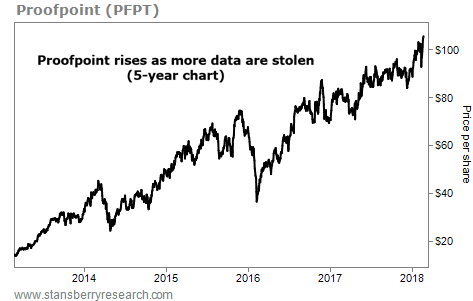

Today, we can see this concept at work in shares of the Proofpoint (PFPT)... Proofpoint's software helps secure companies' communications. It also defends against viruses and hacking attempts. Earlier this month, Proofpoint reported that its sales jumped 36% from last year. Plus, it's setting its sights on future growth. Last year, it took over two other cybersecurity firms, Cloudmark and Weblife.

As you can see in the chart below, Proofpoint has soared. Shares are up more than 620% over the past five years... And they just hit a new all-time high. More companies are turning to companies like Proofpoint for protection...