The Weekend Edition is pulled from the daily Stansberry Digest.

Longtime readers know we keep a close eye on the resource sector...

Longtime readers know we keep a close eye on the resource sector...

Commodities can be a valuable part of a proper asset-allocation plan. Bought at the right time and in the right way, they can help you to diversify some money outside of the traditional asset classes most folks are familiar with (like stocks, bonds, and real estate).

But before you consider investing even $1 of your hard-earned savings, you need to know the most important "law" of the resource sector... Commodities are cyclical.

They can go through spectacular "booms" that are inevitably followed by massive "busts," and vice versa. The reasons aren't complicated, but they're critical to understand...

Like most free markets, supply and demand drive individual resource markets. Whenever supply and demand get "out of whack," the market reacts and corrects the imbalance.

In simple terms, if the supply of a particular commodity becomes scarce relative to demand, prices will rise. Higher prices will attract new capital to the market in search of a profit and encourage existing producers to produce even more.

Supply will rise, prices will fall, and the market will reach an equilibrium again.

It works the other way as well... If supply rises compared with demand, prices will drop. Lower prices encourage producers to scale back production or leave the market altogether.

Supply will fall, prices will rise, and the market will reach an equilibrium again.

It's Economics 101.

In most markets, producers are making these adjustments constantly... Supply and demand rarely get too far out of whack, and prices are relatively stable.

In most markets, producers are making these adjustments constantly... Supply and demand rarely get too far out of whack, and prices are relatively stable.

But the resource markets are different. When supply and demand become imbalanced, it often takes much longer for these markets to react.

Why? Because as our friend and resource expert Rick Rule likes to say, resource markets tend to be both "capital- and time-intensive."

In other words, it typically takes a lot of time and money to build a mine... drill a well... or start a productive farming operation. And once a producer has spent years and millions (or even billions) of dollars to begin producing, it is often hesitant to slow or stop when prices start falling.

This allows the supply and demand imbalances in resource markets to grow much larger and persist far longer than they otherwise would. And it leads to huge price swings with extreme highs and lows you don't see in most other markets.

This also means commodities are often "uncorrelated" to stocks and other assets... And it can be particularly valuable when most traditional assets like stocks and bonds are historically expensive, like they are today.

History is full of examples where commodities have boomed while stocks have fallen or gone sideways. Likewise, in recent years, we've seen many commodities fall during one of the broadest bull markets in history.

In fact, because individual commodities trade according to their own supply and demand dynamics, they often have little correlation with each other. It's not uncommon to see some areas of the resource market boom at the same time that others bust.

In short, when you buy a commodity at the right time – following one of these massive busts, when prices are extremely low – it's possible to make a fortune... regardless of what happens in the broad market.

Our colleagues Steve Sjuggerud and Brett Eversole recently shared one such opportunity...

This commodity's price has fallen more than 60% in a brutal, multiyear bear market. But Steve and Brett believe the next boom is about to begin. As they explained in the March 15 DailyWealth...

Booms and busts...

Investors tend to see them as black swans... or once-in-a-generation events.

But they happen in the stock market more often than most people realize. And they're downright commonplace in the commodities markets.

Today, we've found one commodity that could be at the bottom of a bust cycle... and on the verge of its next boom.

This commodity is more hated than at any point in history. Everyone expects it to continue lower. And that's setting up a contrarian opportunity.

So... what is this commodity? Gold? Copper? Oil?

Nope. It's a market you've probably never considered buying. More from Steve and Brett...

This opportunity is in coffee...

Coffee is dead to investors. It's more hated than ever before, based on one of our favorite measures – the Commitment of Traders (COT) report.

The COT report gives weekly insights into what futures traders are doing with their money. And based on history, when futures traders are all making the same bet, it's smart to take the opposite side of that bet.

Today, futures traders are betting on lower coffee prices. They haven't been this bearish at any previous point in history. Take a look...

As they explained, coffee isn't merely dirt-cheap today...

As they explained, coffee isn't merely dirt-cheap today...

It also has never been more hated than it is right now.

In fact, they note sentiment has only gotten close to this bearish two other times in history. Both occurred in the past five years. And both led to huge returns...

In 2015, coffee hit a similar extreme. Investors were sure the price could only head one direction... down. Instead, coffee soared 45% in just 10 months.

Amazingly, just a year before, there was a similar setup. In 2014, investors were once again betting on the demise of coffee. It didn't work out ... Coffee prices soared 92% in just 11 months.

To be clear, Steve and Brett have not officially recommended buying coffee at this time...

As longtime readers know, Steve prefers to buy assets that are not only cheap and hated, but also in an uptrend. And as you can see in the following chart, coffee – as represented by the iPath Bloomberg Coffee Subindex Total Return ETN (JO) – has not yet started a new uptrend...

If you're looking for a way to diversify your portfolio outside the "Melt Up," coffee is worth a look. History suggests it could nearly double over the next several months no matter what happens to stocks.

But coffee isn't the only "boom" we're tracking in the resource markets today...

But coffee isn't the only "boom" we're tracking in the resource markets today...

There is another that is already underway... And it offers dramatically higher upside potential in the coming years. However, we hesitate to discuss it... You see, simply mentioning this "commodity" in the past has triggered a flood of complaints and led to waves of cancellations.

We're talking about marijuana – or more specifically, legalized marijuana.

We know marijuana use remains a contentious issue for many readers. But like it or not, marijuana is a commodity... And it's rapidly gaining support across the U.S. and around the world.

Today, nine states and Washington, D.C. have legalized recreational marijuana use. Another 21 states have approved it for medical use. All told, more than half the states in the U.S. allow for some sort of legal marijuana use.

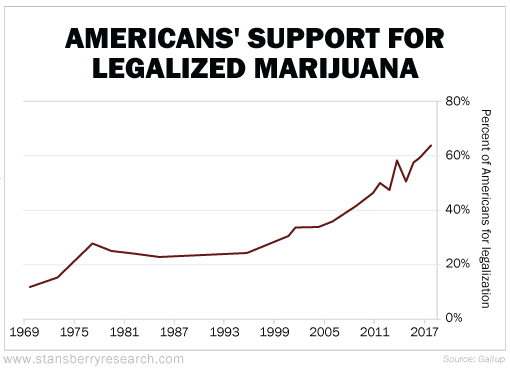

As is often the case, these changes have coincided with a dramatic shift in public opinion. As you can see in the following chart, a survey completed in October from polling and analytics firm Gallup found that 64% of Americans favor legalizing marijuana use...

This is up from just 12% in 1969 and double the percentage of Americans in favor of legal marijuana in 2001.

In short, we've likely reached a "tipping point," where it's simply a matter of time before legal marijuana is available in all 50 states.

We're seeing a similar trend in countries around the world... Several major countries – including Australia, Germany, Italy, Greece, and Mexico – have already legalized medical marijuana.

We're seeing a similar trend in countries around the world... Several major countries – including Australia, Germany, Italy, Greece, and Mexico – have already legalized medical marijuana.

Canada has gone even further... It expects to fully legalize recreational marijuana through the entire country sometime this summer. And the country's financial regulators have already allowed legal marijuana companies to trade on Canada's stock exchanges.

This is where you'll find most of the publicly traded marijuana stocks today... And many have already had incredible runs in the past year.

The two largest producers by market cap in Canada – Canopy Growth (WEED.TO) and Aurora Cannabis (ACB.TO) – are both up roughly 200% or more in the past six months alone. And many smaller, more speculative stocks have soared multiples more.

Of course, one big problem remains... Marijuana remains illegal under federal law in the U.S. and many other countries. This means many American companies risk being shut down by the federal government at any time.

And while we expect the trend toward legalization to continue, we foresee significant regulatory battles ahead. We have no way of knowing in advance exactly how it will shake out... or who the biggest winners and losers are likely to be.

So despite the obvious opportunities in this market – and despite the big gains by early investors to date – we've stayed on the sidelines so far.

But what if there was a way to invest in this trend without exposing yourself to these risks? What if there was a way to profit from this boom without having to choose the winners and losers in advance?

But what if there was a way to invest in this trend without exposing yourself to these risks? What if there was a way to profit from this boom without having to choose the winners and losers in advance?

Commodity Supercycles editor Bill Shaw believes he has found exactly that...

It's a real business with real profits that's ideally positioned to capture the upside of this boom... Yet it has virtually none of the legal or regulatory risk associated with owning marijuana stocks directly. Bill says it's the single best way to profit from the legal marijuana boom today.

It wouldn't be fair to Bill's paid subscribers to share all the details here... But you can get instant access to this recommendation – and all of Bill's in-depth analysis – with a 100% risk-free subscription to Commodity Supercycles. Click here for the details.

Regards,

Justin Brill