Twenty-five years ago, I experienced my first "Melt Up" as an investment professional...

It. Was. Awesome.

And then...

It. Was. Awful.

There's nothing like actually putting your hand on that hot stove to really feel the fire. And I was right in the middle of the fire...

In late 1993, I was a young stockbroker in the U.S., specializing in international stocks.

I didn't know it yet... but man, oh man, I was in the right place at the right time.

It might sound hard to believe, but the big story in 1993 was China... Investors absolutely had to get in.

As a young stockbroker, I quickly learned that you almost never get incoming calls from strangers looking to open an account with you.

Never, that is, except when it's late 1993 and you can buy "China plays" in Hong Kong for your customers. Then you're Mr. Popular! The phone is ringing for you – multiple times a day.

We had "new leads" – potential customers – calling us like you can't imagine.

We had no idea – but we were in the middle of a "Melt Up" in Hong Kong stocks.

Our group of young brokers was giddy coming to work every day. We were making more money than any people in their twenties probably should.

For us, in the middle of it, it felt a bit like bitcoin probably felt late last year. Everybody wanted to buy this market. And we were the ones who could get you in...

In early 1993, the Hang Seng Index – Hong Kong's main stock index – was in the 6,000s. By December, it was approaching 12,000.

In November, and particularly December, it felt like the market was going up every single day.

Then January arrived... And the market started going down! Take a look...

The market lost about 10% of its value in a month. All the talk was of a correction... "Is it over?" I wondered.

Heck no! The phones kept ringing. People who missed the December run-up scrambled to buy in January.

And then... by February, the market started going down again. The phones were still ringing. But it started to feel like the opposite of November and December...

February was awful. It felt like the market went down... on every day of the month.

It wasn't easy to track your Hong Kong holdings back then. We didn't have the Internet. So customers would call... every day. And I'd have to give them the bad news... every day.

Customers wanted to "double down" to "lower their average cost." They were certain China would run back up. But they were wrong.

The grim reality set in. The late-1993 China Melt Up turned into the 1994 China "Melt Down."

I wanted to hide under my desk. My monthly income – which was all based on commission – fell roughly 90%. And it stayed there for about nine months. It was awful.

I went from the top of the world to, well, nearly broke.

I learned two emotionally scarring lessons from that experience:

- A Melt Up is a fantastic ride on the way up. And it is downright awful on the way down.

- I want to be on board for the good times of a Melt Up. And I want to have a plan to avoid the Melt Down.

Since then, I have lived and traded through several Melt Ups. If you are willing to buy any asset class, in any country – like I am – then you will see the pattern repeat itself. You will recognize the signs.

Despite weakness in recent days, I still believe that for the first time since 1999, we are in a Melt Up in U.S. stocks.

Sure, you should sell if you hit your stops. But I believe the recent fall is just one of many corrections on the road to much higher prices.

It might not feel like it right now – but the Melt Up is still in place. Watch your stops... But stay long.

This bull market isn't over yet!

Good investing,

Steve

Further Reading:

"After a nine-year bull market in the U.S., value opportunities in this country are scarce," Brett Eversole writes. But as he explains, that's not true everywhere... Learn more here: One of the Few Cheap Investments in the World Today.

Trailing stops are a great way to limit volatility in your portfolio – but you can do even more to reduce potential losses. In this essay, Porter Stansberry explains how one strategy could help protect you in a real market crash: Did Monday's Market Action Make You Panic?

The "Melt Up" is no longer a U.S. phenomenon. It's happening all over the globe...

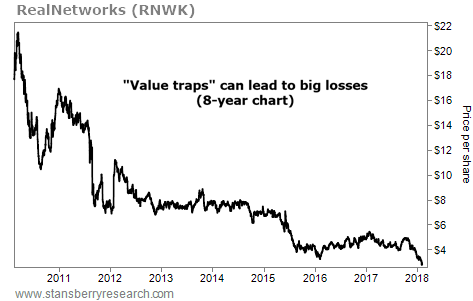

BEWARE OF THE 'VALUE TRAP'

Today, we examine one of the most dangerous things you can do as an investor...

We're talking about buying "value traps." These are companies whose stocks look dirt-cheap. Investors buy a huge stake – only to find their shares are worth even less than the balance sheet suggested. Even investing legend Warren Buffett has fallen prey to this mistake more than once over his 60-plus years in the market.

One of these dangerous companies is digital-media business RealNetworks (RNWK). Before the dot-com bubble burst, RealNetworks was synonymous with streaming video and audio online. In fact, it pioneered the idea. But while the Internet continued to adapt – and quickly – RealNetworks fell behind the curve. One of its worst calls: betting on the wrong horse in the online music trend. It acquired Rhapsody, which got crushed by Spotify and Pandora.

During one of the biggest bull markets in history, RealNetworks has continued to struggle. Shares are down almost 80% over the past eight years. And although shares look cheaper than ever today, it's a helpful reminder that cheap can always get cheaper...