Editor's note: The Federal Reserve's aggressive rate hikes shifted the share-buyback landscape. But according to Joel Litman – founder of our corporate affiliate Altimetry – this is forcing companies to change their ways to avoid getting left behind. In this piece, adapted from a September issue of the free Altimetry Daily Authority e-letter, Joel explains how this could set the stage for long-term growth, once the short-term pain is over...

It used to be easy to reward shareholders... until the Federal Reserve got involved.

For the past 15 years, companies poured billions of dollars into share repurchases. They leveraged the low-interest-rate environment to borrow cash and return it to investors.

Typically, this was seen as a sign of corporate health... and optimism that the business was doing well. And the lower rates went, the more buybacks were announced.

In the first quarter of 2022, share buybacks for companies in the S&P 500 Index reached an all-time high of $281 billion.

Then, the Fed started aggressive rate hikes.

Debt got more expensive. Credit got tighter. And companies realized that borrowing for buybacks didn't make sense anymore. If they wanted to reward investors, they'd have to do it the hard way... by investing in the business.

While share buybacks can be good for investors in the short term, the only way to deliver returns over the long haul is by keeping operations strong.

And that means businesses have to modernize their aging assets.

Corporations are starting to catch on. According to Bank of America, the median U.S. company grew capital expenditures ("capex") 15% in the second quarter versus the same period last year. Share buybacks were down 36%.

As I'll explain, this shift is the start of a long-term trend. U.S. companies have been underinvesting in their assets for more than a decade... and they can't keep it up much longer.

Companies can't borrow at 2% or less anymore. And what's worse, their assets are getting old.

When rates are low, it's more efficient just to borrow money to reward investors. That's what most corporations have been doing... all while neglecting the physical assets that actually power their businesses.

Financing has gotten more expensive. But to keep their businesses running and cash coming in the door – cash that can later be used for buybacks – companies need to invest in long-term assets like property, plants, and equipment (PP&E).

Corporate America has totally ignored this principle... even before the Great Recession. But reinvestment is the only way companies can stay afloat down the line.

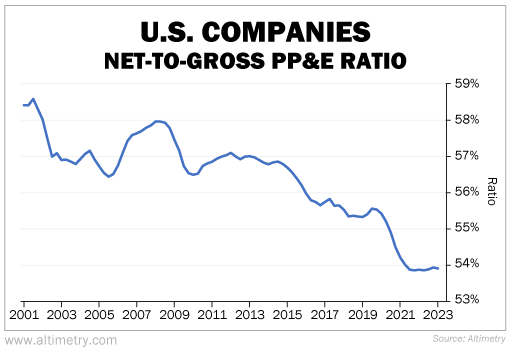

Now, take a look at the chart below. It measures what we call the corporate net-to-gross PP&E ratio.

Gross PP&E represents the value of a company's assets when they were new. Net PP&E tells us what those assets are worth today. The ratio between the two acts as a proxy for the age of assets... The lower the ratio, the older the assets.

As you can see, U.S. companies have been letting their assets languish for years. The ratio of net-to-gross PP&E has fallen from more than 58% in 2001 to just 54% today. Check it out...

If these companies don't change their ways, they'll get left behind as their competition – both domestic and international – makes moves to grow stronger.

This is a big problem in today's challenging environment. That said, we don't expect the U.S. economy to roll over and die...

At Altimetry, I often highlight the importance of what we call the "supply-chain supercycle." We're beginning to see a wave of U.S. infrastructure spending as production comes back to our shores.

The supply-chain supercycle is starting in earnest. And the influx of capital into these projects will likely power the next bull market.

Again, quarterly capex spending just jumped 15% year over year. To get back to a normal net-to-gross PP&E ratio, which is closer to that 58% level from 2001, we'll need a lot more spending.

We're already seeing signs of that today...

Just look at the tech industry, for example. Thanks to the artificial-intelligence boom, chipmakers are increasingly investing more in onshore production. Even tech giants like Apple (AAPL) have started building more manufacturing facilities on or near U.S. soil.

We're facing a lot of short-term uncertainties about the economy and a likely recession... But looking ahead, the U.S. is poised for substantial growth over the next five to 10 years.

Companies are just getting started investing in their operations. They can't rely on the "easy money" era to pump shareholders full of cash anymore.

This will benefit supply chains across the U.S... And the businesses that ramp up capex spending will lead the charge higher.

Regards,

Joel Litman

Editor's note: The era of "easy money" is over. And according to Joel, a lot of companies are likely to get left behind in 2024. But that doesn't have to be the end of your financial future...

Joel has identified a rare type of stock with the potential to soar during mass fear and volatility. And it's crucial to position yourself now, before January 1 – because he predicts investors are in for a bumpy ride next year. Joel recently teamed up with Chaikin Analytics founder Marc Chaikin to reveal the details... If you missed their conversation, watch the video right here.

Further Reading

"The Federal Reserve's aggressive rate hikes are putting pressure on riskier companies," Joel writes. Banks aren't offering loans to just any company today – they're being strategic with their handouts. And that spells trouble for certain businesses... Read more here.

As investors, we want to see honesty from management teams. It matters more than you might think... especially when the market gets tough. Here's why candid management actually points to stronger stock performance – and how it could save you from potential risks or surprises down the line... Learn more here.