Editor's note: "Being right that the market is wrong" is a difficult art. That's why according to Rob Spivey – director of research at our corporate affiliate Altimetry – every investor should ask themselves three questions before jumping into an investment. In this article, adapted from a recent issue of the free Altimetry Daily Authority e-letter, Rob shares what it takes to beat the market...

Putnam Investments' research office was the stuff of legends...

In the late 1990s, Putnam's Boston-based office was famous among investors for a massive sign near its research stables. At the top of the sign, it said, "We Invest in Change."

Below that was a list of "changes" it deemed buy signals. The list included changes in management, products, regulations, and any other factors the market might be missing.

Investors liked this way of thinking... and poured money into Putnam's funds. Its assets under management grew an average of 29% per year from 1991 to 1999, reaching more than $400 billion.

Putnam's success stemmed from its ability to understand one crucial tenet... that business models aren't as black and white as they seem.

Bad businesses that find ways to beat expectations can be amazing investments. And great businesses can become so highly valued that they'll never meet expectations.

Today, I'll take a closer look at the most important stock-picking ingredients... and how Putnam used one of them to grow like crazy.

Beating the market is a three-step process.

When picking a stock, you first must ask yourself...

1. What does the market expect this company to do?

This is just another way of saying you need to look at valuations. The price-to-earnings ratio, which measures stock price versus earnings per share, is a basic way to value a company.

The second question has two parts...

2. Can the company do something different from what the market expects? And why am I confident about this?

This step requires you to question the market. For instance, after looking at a company's valuation, you might realize investors' growth estimates are a lot lower than yours.

But it's the third and final question that Putnam mastered... and it's the one investors tend to struggle with the most.

3. What is going to change to make the market realize it's wrong?

One critical change can send your investment on a one-way trip higher. Without this catalyst, you're playing a waiting game that can take years... if it ever happens at all.

In fact, change is responsible for one of Altimetry's all-time greatest hits...

Online real estate manager eXp World (EXPI) offers a virtual solution for real estate brokers to interact with clients and manage their businesses.

Investors thought eXp would never take off. But then the pandemic hit... one of the biggest changes we've seen in decades. Suddenly, homebuying demand surged, and folks were looking for virtual ways to enter the housing market.

Those virtual platforms became far more popular... and so did eXp stock.

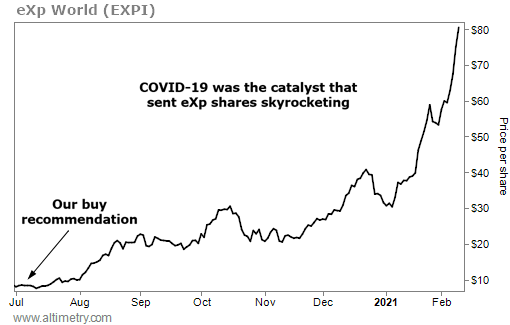

We recommended eXp to our Microcap Confidential subscribers in July 2020. In a little more than a month, it doubled. By February 2021, subscribers who followed our advice were up 860%.

And it was all because the market scrambled to embrace a key change in the business environment. You can see its upward trajectory below...

We were so successful with eXp because we embraced what Putnam knew – one of the most powerful ways to invest is by observing change.

Now, today's investors tend to do a good job of understanding what a company is worth right now as long as it keeps doing what it's doing. Most of the time, they've priced in any data that's already out there.

But let's say a business is looking to stave off bankruptcy by restructuring or refinancing... and investors expect it to go under. If it succeeds, anyone who's paying attention could make a lot of money.

It doesn't mean the company is great. It was simply priced to go bankrupt... and then it didn't.

You're investing in the idea behind the change – not necessarily the idea behind the business. If you can't find that key catalyst in an investment, you might as well pass on it. The market might never realize it's wrong.

What you're looking for can come in many forms, whether it's change in management... change in business strategy... change in capital structure... change in macro trends... change in competition... or change in customers and vendors.

But no matter what it is, when you see something big brewing, that's when you should pay attention.

Because that's when the market will start to pay attention, too.

Regards,

Rob Spivey

Editor's note: A rare situation is unfolding in the market today that shouldn't exist. But according to Stansberry Research founder Porter Stansberry and Altimetry founder Joel Litman, it could be the biggest moneymaking story of 2024. On Tuesday, March 26, at 10 a.m. Eastern time, Porter and Joel are sitting down to discuss this market anomaly... and how you can take advantage of it. Click here to learn the details.

Further Reading

It takes guts to go against the crowd. But a contrarian mindset can give you an edge as an investor. One secret will help you use this way of thinking effectively – and once you understand it, it can lead to some of the best buying opportunities... Read more here.

Wall Street loves to push the narrative that individual investors should rely on professionals. But that's a lie. You can succeed on your own by doing exactly what the "experts" say you shouldn't do – that is, timing the market... Learn more here.