The Weekend Edition is pulled from the daily Stansberry Digest.

Back in February, we spotted two bullish signs for the gold market...

Back in February, we spotted two bullish signs for the gold market...

First, despite a rising U.S. dollar, gold was quickly closing in on multiyear highs. Second, and perhaps more important, gold-mining stocks were suddenly outperforming the precious metal itself for the first time in several years. As we explained in the February 23 DailyWealth...

As longtime readers know, comparing the performance of gold stocks to gold itself – through the so-called "gold stocks to gold ratio" – can be valuable.

Because gold stocks provide leverage to the price of gold, they tend to rise much faster than gold during bull markets... and fall much faster than gold during bear markets. So if this were the start of a new uptrend in gold, we would expect to see this ratio moving sharply higher.

As you can see in the following chart, that's exactly what has happened...

Since making a new multiyear low last fall, this ratio has moved sharply higher. And it is now just shy of making its first "higher high" in nearly three years.

As we mentioned at the time, this was a big deal...

As we mentioned at the time, this was a big deal...

We hadn't seen a similar move since early 2016, just before gold and gold stocks soared. More from that DailyWealth...

Over the next several months, gold rallied almost 25%, while gold stocks – as tracked by the VanEck Vectors Gold Miners Fund (GDX) – surged nearly 140%.

After the big rally over the past few months, we wouldn't be surprised to see gold take a "breather" soon. But it's looking more and more likely that a new gold bull market is already underway.

Gold has stuck to this "script" so far...

Gold has stuck to this "script" so far...

Prices peaked at $1,347 an ounce that same week and trended lower through early May.

But this month, gold exploded to the upside. As you can see in the updated chart below, gold has now officially broken out to a new six-year high...

And as you can see in the next chart, the gold stocks to gold ratio has finally made a "higher high" as well...

As always, we'll remind you there are no guarantees in the markets.

But these charts paint an incredibly bullish picture for gold. And as we noted last week, if it can close solidly above $1,400 an ounce, gold could rally several hundred dollars higher in a hurry.

Of course, technical analysis – or "chart reading" – isn't the only reason to be bullish on gold today...

Of course, technical analysis – or "chart reading" – isn't the only reason to be bullish on gold today...

For the first time in years, we also have a strong fundamental reason as well.

Earlier this month, we noted that the Federal Reserve is now expected to begin cutting interest rates this year. In fact, futures markets are now pricing in a 100% chance of the first cut by July... an 80% chance of a second cut in September... and a 41% chance of a third cut in December.

But as our colleagues Ben Morris and Drew McConnell recently noted to their DailyWealth Trader subscribers, the Fed is not alone...

, the U.S. Federal Reserve followed in the footsteps of the European Central Bank. Then , the Bank of Japan did the same.

The developed world's three largest central banks all suggested that monetary stimulus is on the way... and probably soon. The details of what these banks choose to do isn't the point.

The point is that now, without question, the tone has changed... The "world economies are improving" commentary is gone. The "headwinds are blowing" commentary is here.

On top of that, the U.S. government is blaming Iran for bombing Japanese oil tankers and Iran's Revolutionary Guard just shot down a U.S. drone. Geopolitical tension is rising.

In short, the "pause" of the past couple of years appears to be over...

In short, the "pause" of the past couple of years appears to be over...

The world's big central banks are all preparing to flood the world with "easy money" once again.

Add in rising geopolitical tensions, and you have a recipe for an explosive move higher in gold. More from Ben and Drew...

Governments around the world are standing at the line, ready to get back into the race to devalue their currencies. So once again, gold and silver look attractive as a form of savings compared with paper currencies.

Precious metals also tend to perform well when geopolitical tensions rise, which is why we mentioned the news about Iran above.

Now, we're seeing these ideas in action...

If you haven't followed our advice to accumulate physical gold and silver over the years, maybe this is the sign you were looking for. If you don't hold at least 5%-10% of your wealth in precious metals, start buying today.

Elsewhere in the market, regular DailyWealth readers may recall that our friend Whitney recently Tilson made a bold prediction on Tesla (TSLA)...

Elsewhere in the market, regular DailyWealth readers may recall that our friend Whitney recently Tilson made a bold prediction on Tesla (TSLA)...

In short, after years of telling folks not to short the electric-car maker, Whitney famously "called the top" this spring. As he wrote in the April 6 DailyWealth...

Ever since I (Whitney) got burned shorting the stock in 2013 – watching it march higher from $35 to $205 a share – I've warned my readers about betting against CEO Elon Musk and his team. They've simply pulled too many rabbits out of their hat over the years...

But Tesla has almost done too good of a job. Now, it faces a massive wave of competition. Electric cars from high-end European manufacturers Audi and Jaguar are already vastly outselling Tesla's Model S and Model X cars in Europe. Meanwhile... Toyota, Kia, Hyundai, Volkswagen, Nissan, and Renault are developing their own lower-priced electric vehicles.

As a result of this new competition, I told readers of my free daily e-letter last month that Musk has no more rabbits to pull out of his hat.

I believe Tesla's stock – which closed yesterday around $268 a share – will be trading below $100 by the end of 2019.

By May, Whitney's call was already looking prescient. Shares had fallen nearly nonstop since he first issued his warning and had just closed below $200 for the first time since 2016.

Of course, even the best short sales don't move in a straight line lower...

Of course, even the best short sales don't move in a straight line lower...

Since then, shares have rebounded sharply to near $225 earlier this week, leading many Tesla bulls to declare the worst is over.

So, is Whitney ready to throw in the towel? He shared his latest thoughts on the stock with his Empire Financial Daily readers on Monday. Because he knows many DailyWealth readers are following this story, he's allowed us to share some of it with you today. From his note...

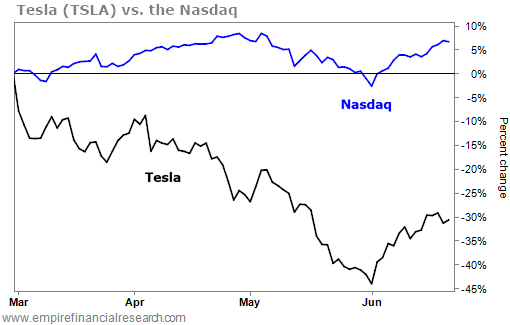

Despite its recent bounce, the stock is still down 30% since my March 4 prediction that it would hit $100 by the end of the year, while the Nasdaq is up 7%...

As Whitney explained, the recent rebound has been fueled by optimism that Tesla's second quarter won't be as bad as some feared...

As Whitney explained, the recent rebound has been fueled by optimism that Tesla's second quarter won't be as bad as some feared...

In particular, Tesla CEO Elon Musk recently told employees that the company could reach a record number of deliveries and sales this quarter. But Whitney remains unconvinced. More from his note...

This is unlikely. Recall that when the company reported first-quarter earnings, it guided to 90,000-100,000 deliveries in the second quarter.

For a while, it looked like it wouldn't even hit 80,000. But as usual, there's been a mad rush of late-quarter deliveries. My best estimate is that the company might hit 85,000. That's still more than 10% below the guidance midpoint, but not a total debacle on this metric. Thus, the stock might even pop when the company releases this number (likely sometime between July 1 and July 3), especially if it maintains its outlook for full-year deliveries to be between 360,000 and 400,000 vehicles.

The key question is, how much price-cutting did Tesla have to do to move cars? After all, if the company sold cars for $1, it could sell an almost infinite number... This, plus how well it controlled expenses, will determine how much money Tesla made or lost in the second quarter. (We won't know this until the company reports earnings on or about August 7.) I expect the company to show a big loss in the second quarter – though less than it did in the first quarter, when it only delivered 63,000 cars and lost a staggering $702 million.

In the meantime, the avalanche of senior executive departures continues and another analyst admitted he "got it wrong this year" and cut his price target from $400 to $300. Plus, Morgan Stanley analyst Adam Jonas is sticking to his $230-a-share price target, but last month he admitted it could go as low as $10 in a worst-case scenario...

I stand by my $100 target by year-end.

One last thing...

One last thing...

As regular readers know, Whitney launched his own flagship investment newsletter – the Empire Investment Report – earlier this spring...

We know many of you took advantage of the opportunity to try this new service at a huge discount. But if you weren't able to join them, you now have a second chance...

Whitney has decided to open the Empire Investment Report to new subscribers at a significant discount for a limited time. While it's too late to become a charter member of this service, you can still take advantage of a 40% discount off the normal price.

Click here for all the details.

Regards,

Justin Brill

Editor's note: Whitney has nailed so many major market calls with such accuracy that CNBC called him "The Prophet." For the first time in his 20-year career, Whitney has agreed to sit down exclusively with Stansberry Research and share the powerful strategy he used to grow his hedge fund from $1 million to $200 million... including exactly what "The Prophet" is predicting next for 2019. Get the details here.